- Get link

- X

- Other Apps

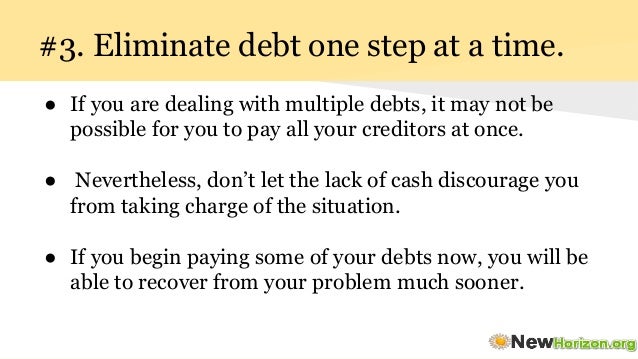

Target One Balance at a Time By focusing on just ONE area of your finances you will not only eliminate debt faster you will also be more organized in your approach. But if that strategy isnt right for you there are several others you can consider.

8 Easy Ways To Reduce Debt Navigate With Price

8 Easy Ways To Reduce Debt Navigate With Price

79 had debt outstanding compared to 71 in 2019 Business owners often tell me Im so badly in debt I dont know what to do So Ive put together a five-step plan to help eliminate debt.

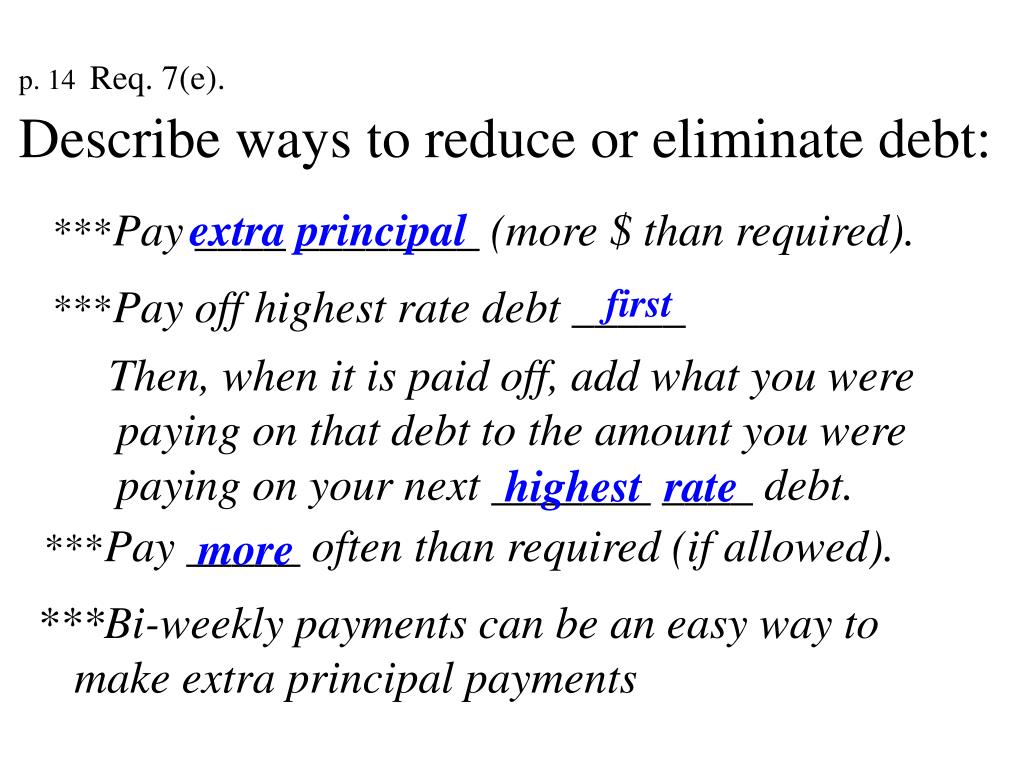

How to reduce or eliminate debt. If youre going to aggressively reduce your debt youre going to need to free up some additional money. There are two basic strategies that can help you reduce debt. How to Eliminate Debt.

Repeat this method as you plow your way through debt. Putting money in an emergency fund may sound counterintuitive if youre trying to get out of debtyou could be using that money to pay off your debt instead of sticking it in a savings accountbut an emergency fund can actually keep you from creating more debt. Invest in your health and in your valuable assets.

Stick to Your Terms Stop supplying customers who havent paid their accounts on time. For example Saudi Arabia reduced its debt burden from 80 of. If you want some great debt collection software to manage your own debts try Debtor Daddy.

We recommend using the debt avalanche method since its the best way to pay off multiple credit cards when you want to reduce the amount of interest you pay. How to Lower Credit Card Debt with the Help of Your Lender. Write down your monthly budget using bank statements during this process will help give you more accurate estimate and identify some areas ripe for reduction.

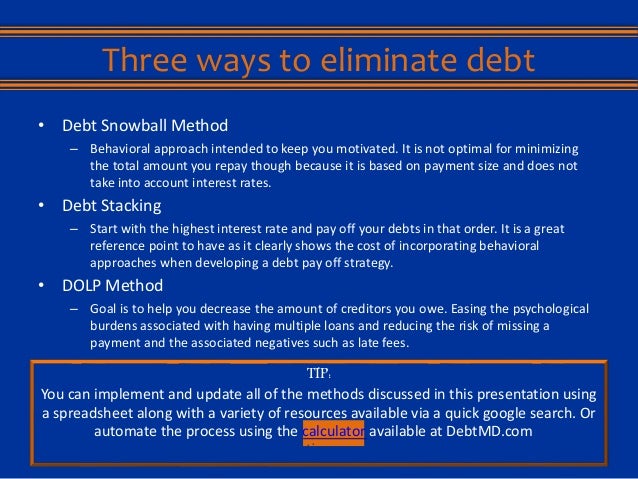

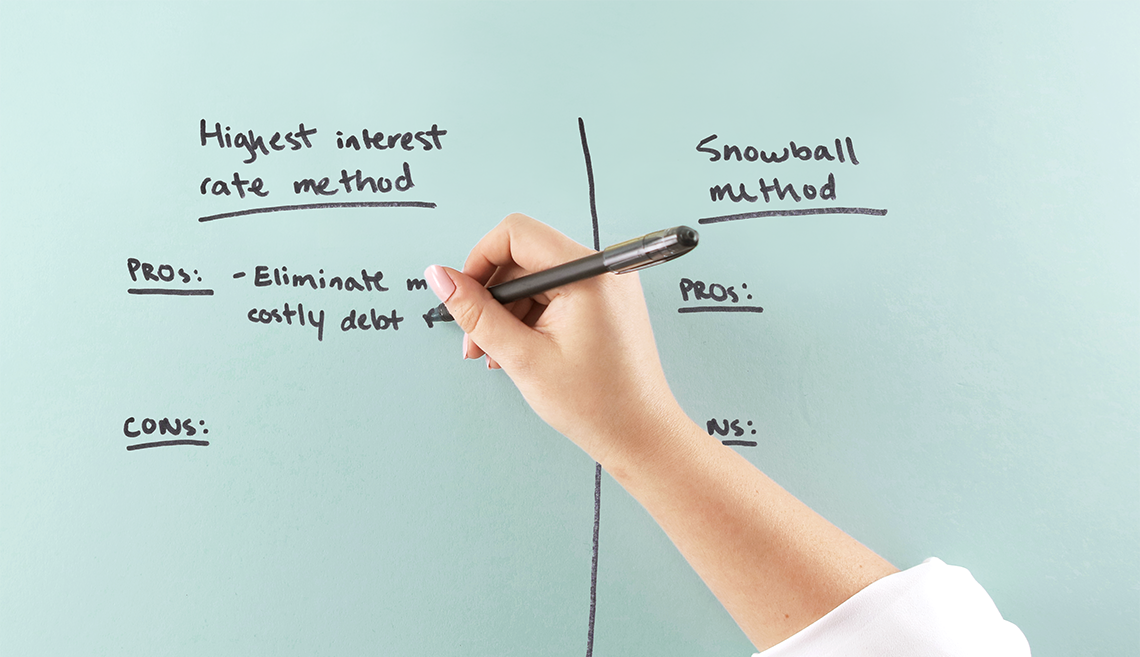

Create a budget and stick to it. A pro-business pro-trade approach is another way nations can reduce their debt burdens. The highest interest rate method and the snowball method.

Highest interest rate method This approach focuses on your debts like credit card and student loan debts with the highest rate of interest. Keep your cards out of sight and out of mind. There are a couple different methods to do this one is to focus on the lowest debt amount you have to get rid of it as quickly as possible or focus on the debt with the higher interest rate.

Lower your credit limit. Add another stream of income. Five Practical Ways to Eliminate Debt and Build Wealth.

Once you pay off the smallest debt take that payment and apply it to your next-smallest debt. These savings provide you with a safety net you can use for emergency expenses which saves you from reaching for your credit card. Attack the smallest debt with a vengeance while making minimum payments on the rest of your debts.

Look Baby Step 2 takes a few months to finish for some people and a few years for others.

The Snowball Effect How To Eliminate Your Debts While Maintaining Yo

The Snowball Effect How To Eliminate Your Debts While Maintaining Yo

Should You Pay Off Your Debt Or Save Money Advance America

Should You Pay Off Your Debt Or Save Money Advance America

/struggling-with-debt-586720824-5884060b5f9b58bdb3fe303e.jpg) How To Reduce Or Eliminate Debt

How To Reduce Or Eliminate Debt

Amazon Com How To Reduce Your Debt Overnight A Simple System To Eliminate Credit Card And Consumer Debt Fast Ebook Corson Knowles Tom Kindle Store

Amazon Com How To Reduce Your Debt Overnight A Simple System To Eliminate Credit Card And Consumer Debt Fast Ebook Corson Knowles Tom Kindle Store

5 Ways To Reduce Financial Stress

5 Ways To Reduce Financial Stress

How To Reduce Or Eliminate Small Debt Tips From A Sumup Payment Expert

How To Reduce Or Eliminate Small Debt Tips From A Sumup Payment Expert

How To Effectively Eliminate Debt Farber Debt Solutions

How To Effectively Eliminate Debt Farber Debt Solutions

Ppt Disadvantages The Interest They Pay As Much As I D Like Powerpoint Presentation Id 4772021

Ppt Disadvantages The Interest They Pay As Much As I D Like Powerpoint Presentation Id 4772021

Debt Settlement Cheapest Way To Get Out Of Debt

How To Reduce Your Debt Consumer Financial Protection Bureau

How To Reduce Your Debt Consumer Financial Protection Bureau

Dig Yourself Out Of Debt How To Reduce And Eliminate Your Debt For A Life Of Financial Freedom Kessler Christopher Mortorano Michael 9781482577099 Amazon Com Books

Dig Yourself Out Of Debt How To Reduce And Eliminate Your Debt For A Life Of Financial Freedom Kessler Christopher Mortorano Michael 9781482577099 Amazon Com Books

/will-the-u-s-debt-ever-be-paid-off-3970473-finalv2-acb523b4dacf43529f4915254c600777.png) Will The Us Debt Ever Be Paid Off

Will The Us Debt Ever Be Paid Off

How To Reduce Credit Card Debt Consolidated Credit

How To Reduce Credit Card Debt Consolidated Credit

3 Ways To Reduce Or Eliminate Personal Debt Inspire Fcu

3 Ways To Reduce Or Eliminate Personal Debt Inspire Fcu

Comments

Post a Comment